SBA 504 Loan Details

SBA 504 loan projects require bank lender, typically financing 50% of the project and BEFCOR financing 40% with a 504 loan.

The general program’s parameters for SBA 504 loans include:

- Terms of 10, 20, or 25 years

- Fixed interest rates for the full term of the loan

- Loans amortize over term – no balloons or rate resets

- Amounts range from $25,000 - $5,000,000

- Some businesses may qualify for up to $5,500,000

- Interest rates are typically below market, even when nominal fees are added

Can you get a 504 loan from a bank?

No. SBA 504 loans are available only from “certified” organizations, such as BEFCOR. Banks do not offer SBA 504 Loans, but they are essential partners with BEFCOR to make sure small businesses benefit from SBA financing.

Financing and Eligibility

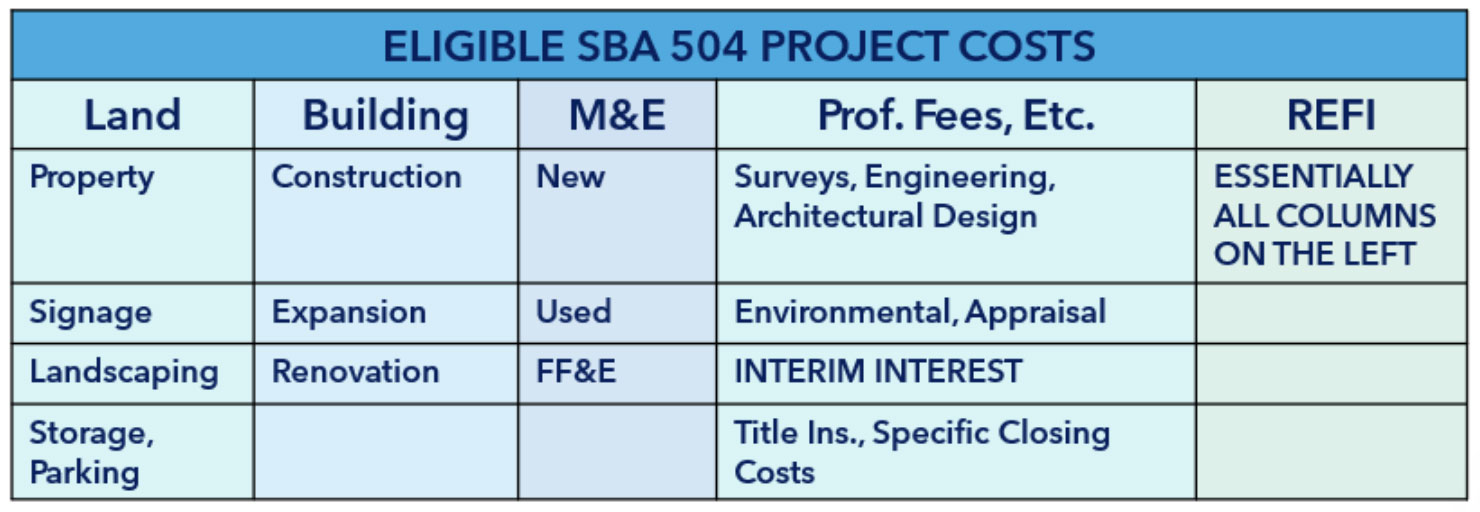

So, you may be asking, “What types of projects can SBA 504 loans finance?” Below is a table of the assets that can be financed.

Also, most small businesses are eligible.

According to SBA’s website:

To be eligible for a 504 loan, your business must:

- Operate as a for-profit company in the United States or its possessions

- Have a tangible net worth of less than $20 million

- Have an average net income of less than $6.5 million after federal income taxes for the two years preceding your application

Other general eligibility standards include falling within SBA size guidelines, having qualified management expertise, a feasible business plan, good character and the ability to repay the loan.

Loans cannot be made to businesses engaged in nonprofit, passive, or speculative activities.

Contact us – the experts at BEFCOR are ready to discuss the SBA 504 program.

SBA 504 Loan Guide

SBA 504 loans, when combined with traditional financing from banks, credit unions, or non-bank lenders, form a powerful partnership that provides business owners with favorable terms designed to support long-term growth and success.

SBA 504 Loan Calculator

SBA 504 Refinancing - New and Improved!

For businesses that have balloon payments approaching or those who need to reduce their payments due to high interest rates, SBA 504 loans can provide refinancing of fixed assets. As expected, there are some rules. However, our team will provide the expertise to determine if projects and businesses are eligible. The result is lower payments, better cash flow, and fixed interest rates on the SBA 504 loan.

Originally Fixed Assets

(> and equal to 75%)

Cash-Out Permitted

Refinance of Government- Guaranteed Debt

Often, No

Downpayment Required

SBA 504 Application Steps

BEFCOR streamlines the SBA 504 loan application by working closely with both business owners and their bank partners to reduce duplication and simplify the process. With more than 100 years of combined experience, the team guides applicants through each step—from collecting documents to internal review, Loan Committee approval, and final SBA processing. Although timelines vary based on how quickly information is submitted, borrowers often find the experience smooth and efficient, with many returning for additional loans as their businesses grow.

To begin, applicants submit key documents such as business tax returns, financial statements, organizational documents, project cost details, owner resumes, personal financials, business descriptions, and the BEFCOR application.

SBA 504 or 7a? SBA 504 and 7a?

If you are familiar with other SBA programs, you might be wondering if BEFCOR offers SBA 7a loans. While we are not a 7a lender, we specialize in SBA 504 loans! We are your 504 experts!

It's important to note that while many businesses may qualify for both 504 and 7a programs, the 504 program stands out for its lower fixed interest rates, lower down payments, and long repayment periods without rate changes or balloon payments.

In some projects, businesses can benefit greatly from using BOTH programs in the same project, allowing them to enjoy the benefits of both SBA 504 and 7a. We welcome the opportunity to explain!

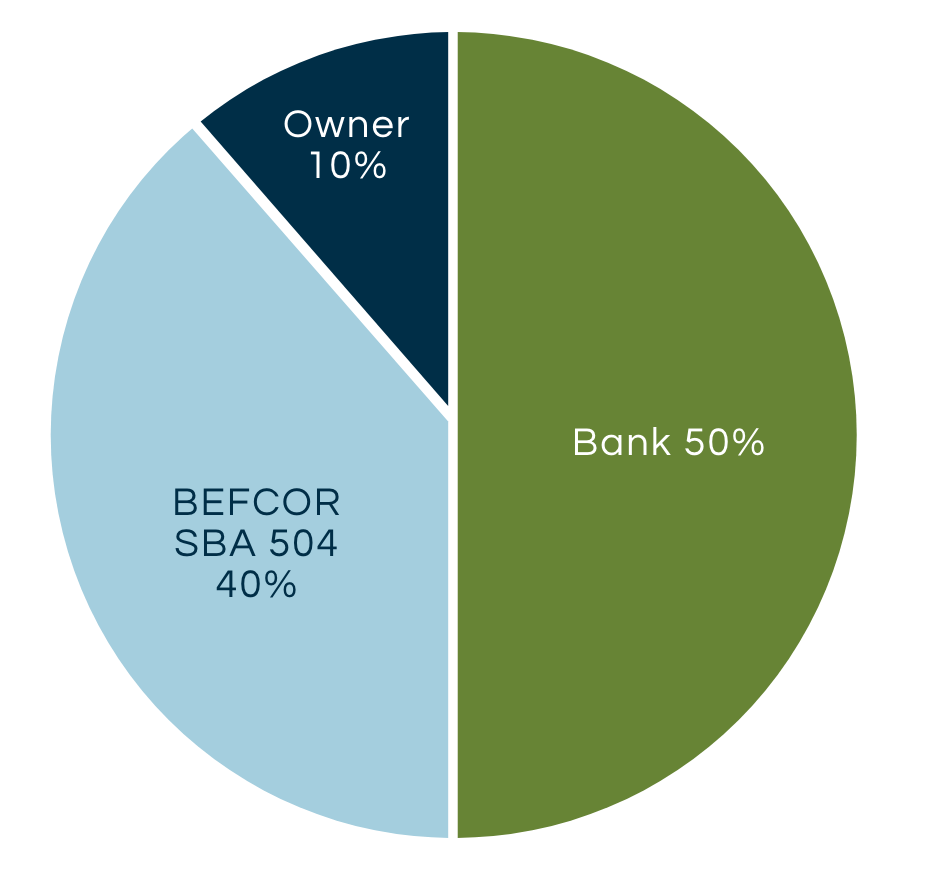

The example illustrates how an SBA 504 loan program generally works: Two lenders each provide a portion of the loan request. The bank, or traditional lender, takes the lead and finances the first 50%. BEFCOR, through the SBA 504 program, finances 40%, and the small business usually contributes 10%. (Please note that program guidelines can alter the percentages – our example is the most common.)

SBA 504 loans, as shown in the example, reduce the downpayment required of the small business, and provide a low fixed interest rate to support the business’ cash flow.

The example illustrates how an SBA 504 loan program generally works: Two lenders each provide a portion of the loan request. The bank, or traditional lender, takes the lead and finances the first 50%. BEFCOR, through the SBA 504 program, finances 40%, and the small business usually contributes 10%. (Please note that program guidelines can alter the percentages – our example is the most common.)

SBA 504 loans, as shown in the example, reduce the downpayment required of the small business, and provide a low fixed interest rate to support the business’ cash flow.